At our most recent team meeting we decided that to progress our concept we needed to hear from real to learn how they shop. We decided a 10 question survey would work best. Together we created a 10 question survey in which we had 50 female respondents. The statistics gave us an insight into what women value when shopping which will benefit our app to ensure we are giving our target market what they want.

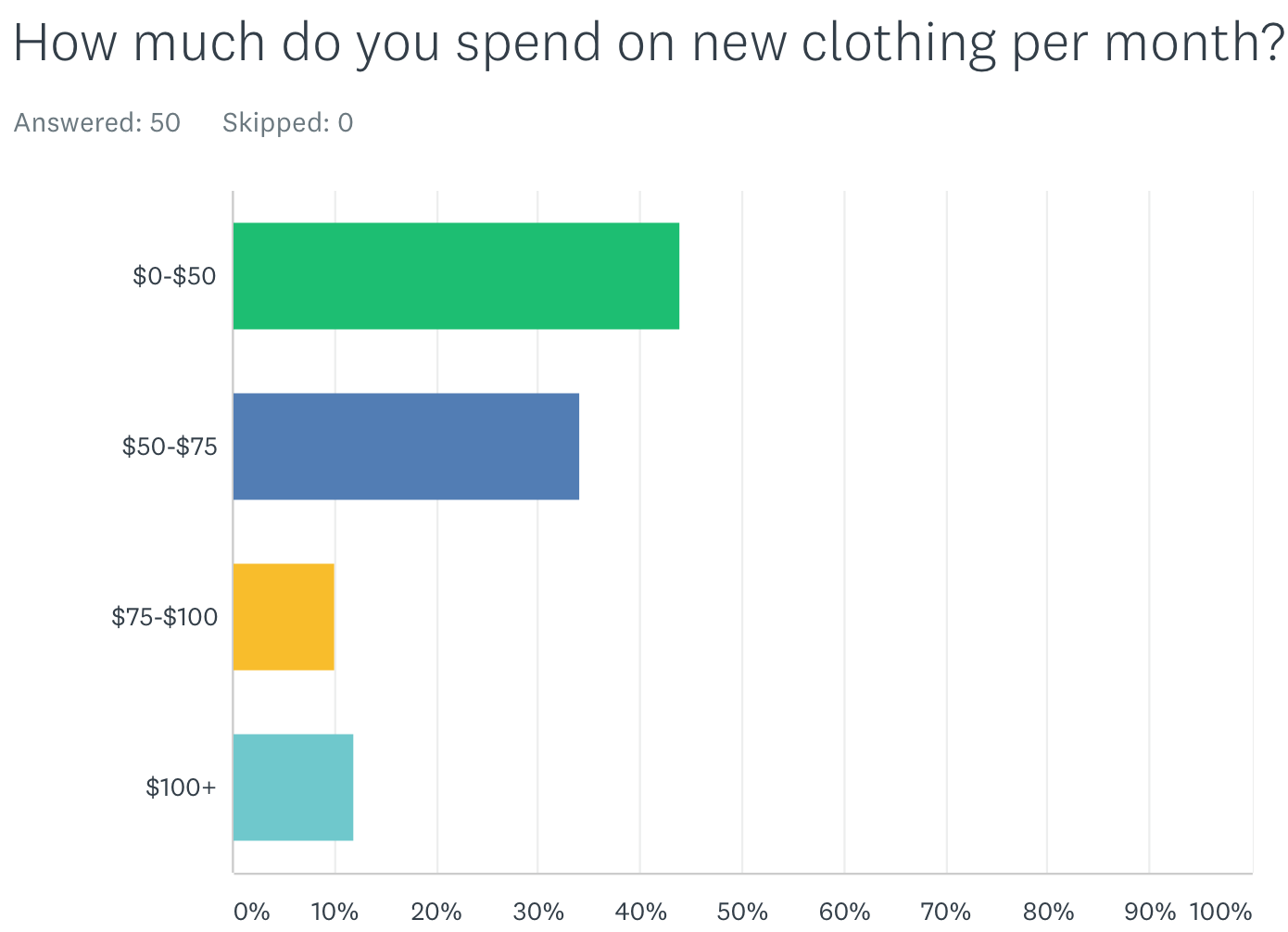

Q1) How much do you spend on clothing per month?

By asking our target market how much they spend on new clothing per month we were able to determine how we price our subscription packages. Most respondents spend up to $75 on clothing per month. Therefore if we could offer a subscription package that is slightly cheaper but results in more garment wears we can achieve our goal. From these results we will price our ”standard” subscription option somewhere between $40-$75, and the high end ”platinum” option more around the $100 mark.

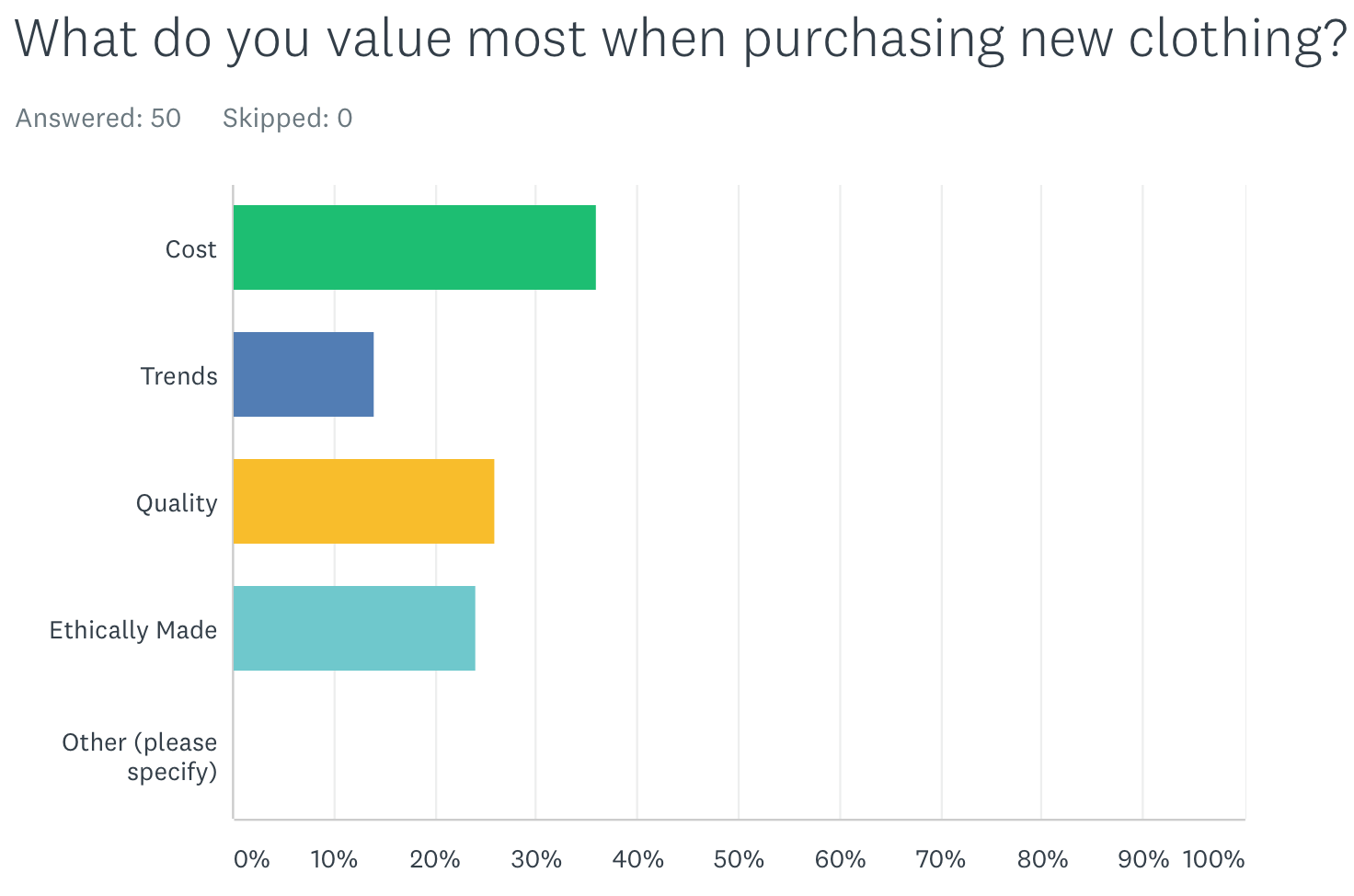

Q2) What do you value most when purchasing new clothing?

From this question we wanted to know what our target market value most when shopping so that we know what to make most important in our business. The most common answer was cost, followed by quality and ethically made. As a business we want to rent out high quality, ethically made clothing at a cheaper price point. Our business establishes a balance between cost and quality by using a rental system process. By promoting renting we are helping to reduce clothing consumption and waste. To ensure all items on our app are of a high quality we will only partner with high end brands who we trust. We will also quality check all of our garments before we offer them to rent.

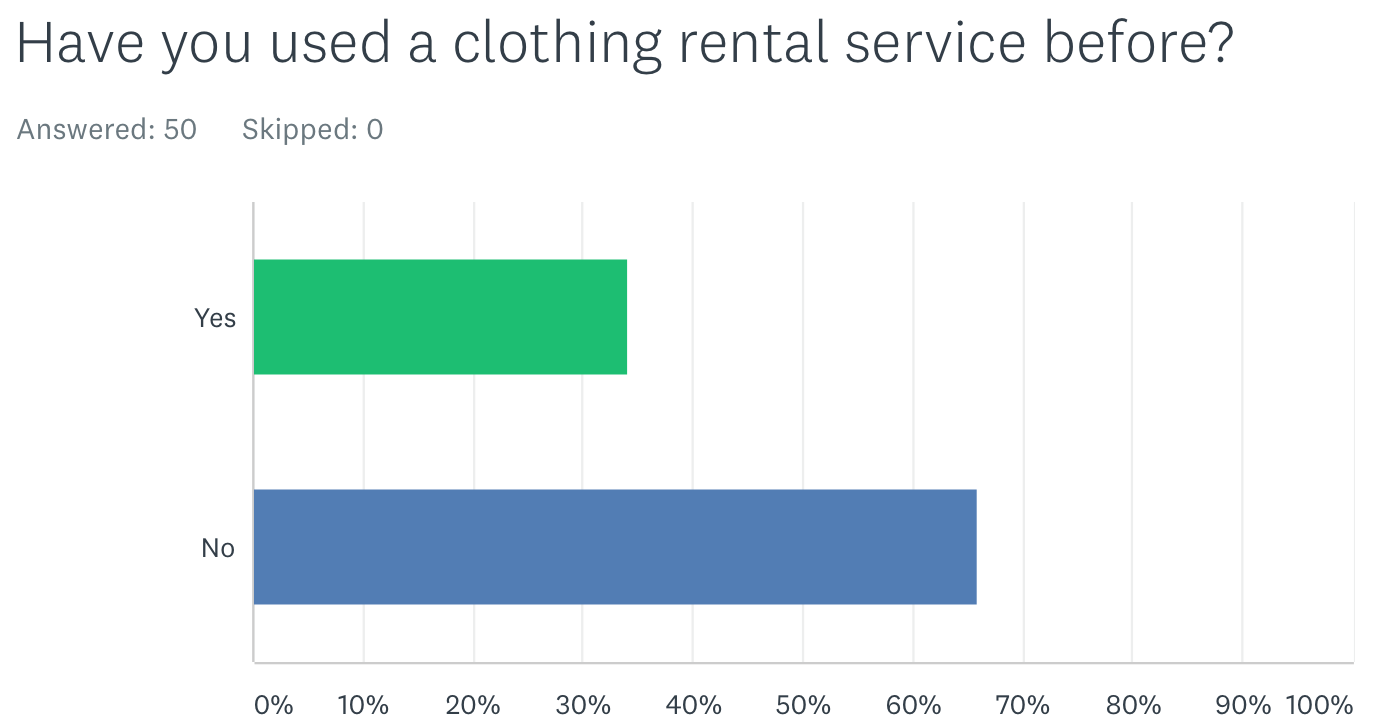

3) Have you used a clothing rental service before?

Our third question was more out of curiosity. We wanted to find out how aware people were of rental services. Majority of respondents had never used a rental service. We presume a reason for this could be that these respondents are unaware of rental services and how they work. Therefore, to increase the number of women using rental services, such as Refresh, we need to put an emphasis on promotion whether this be through social media, news outlets, magazines, or even in physical stores.

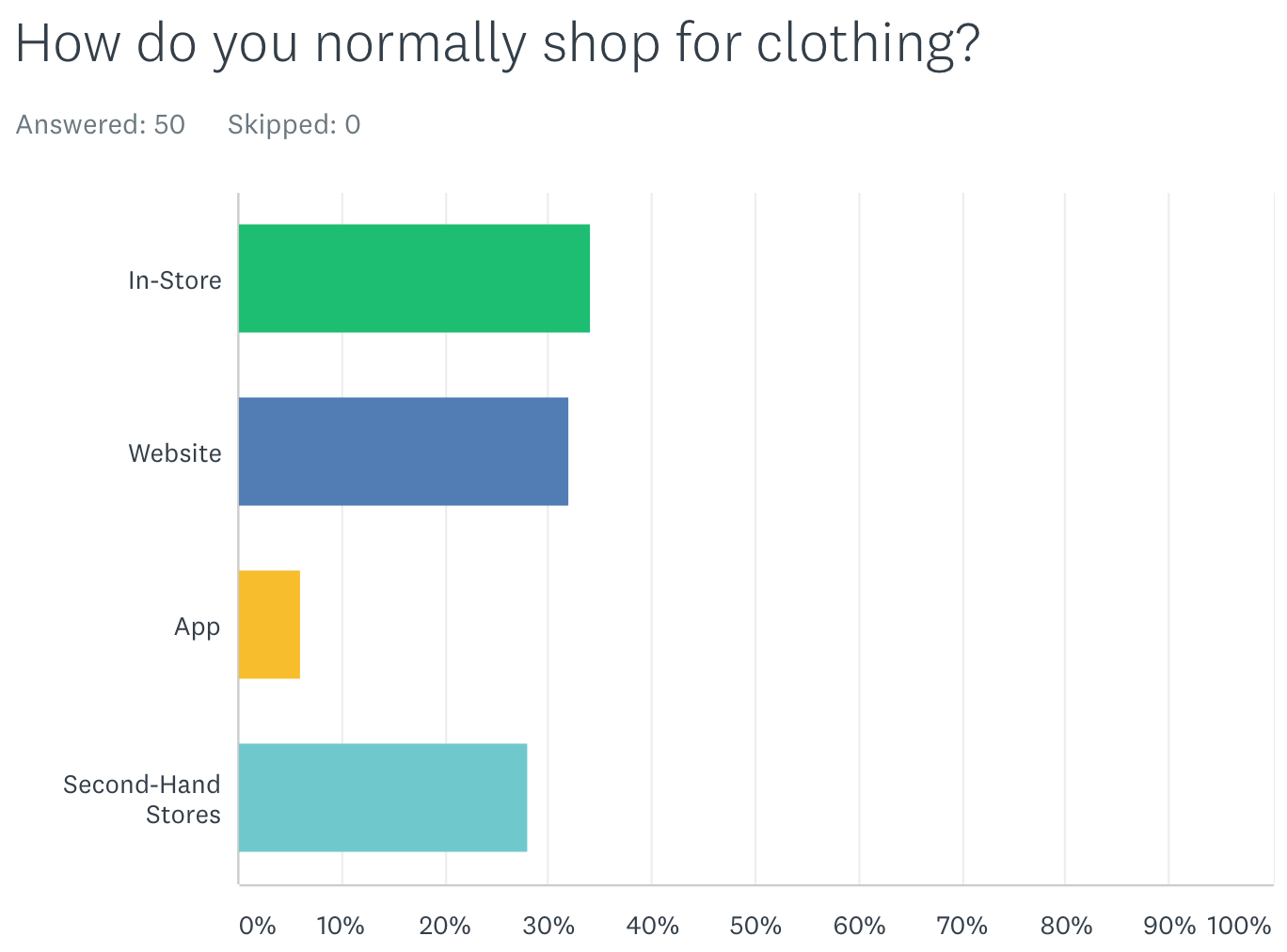

Q4) How do you normally shop for clothing?

For our fourth question we wanted to find out what platform women tend to use when shopping. Most women shop in-store or through a website. Less than 10% of respondents said they shopped through an app. We believe this is due to the lack of shopping apps or the respondents being unaware of shopping apps. This question has also made us think about establishing a website alongside the app. This way our customers would be able to access Refresh from more platforms.

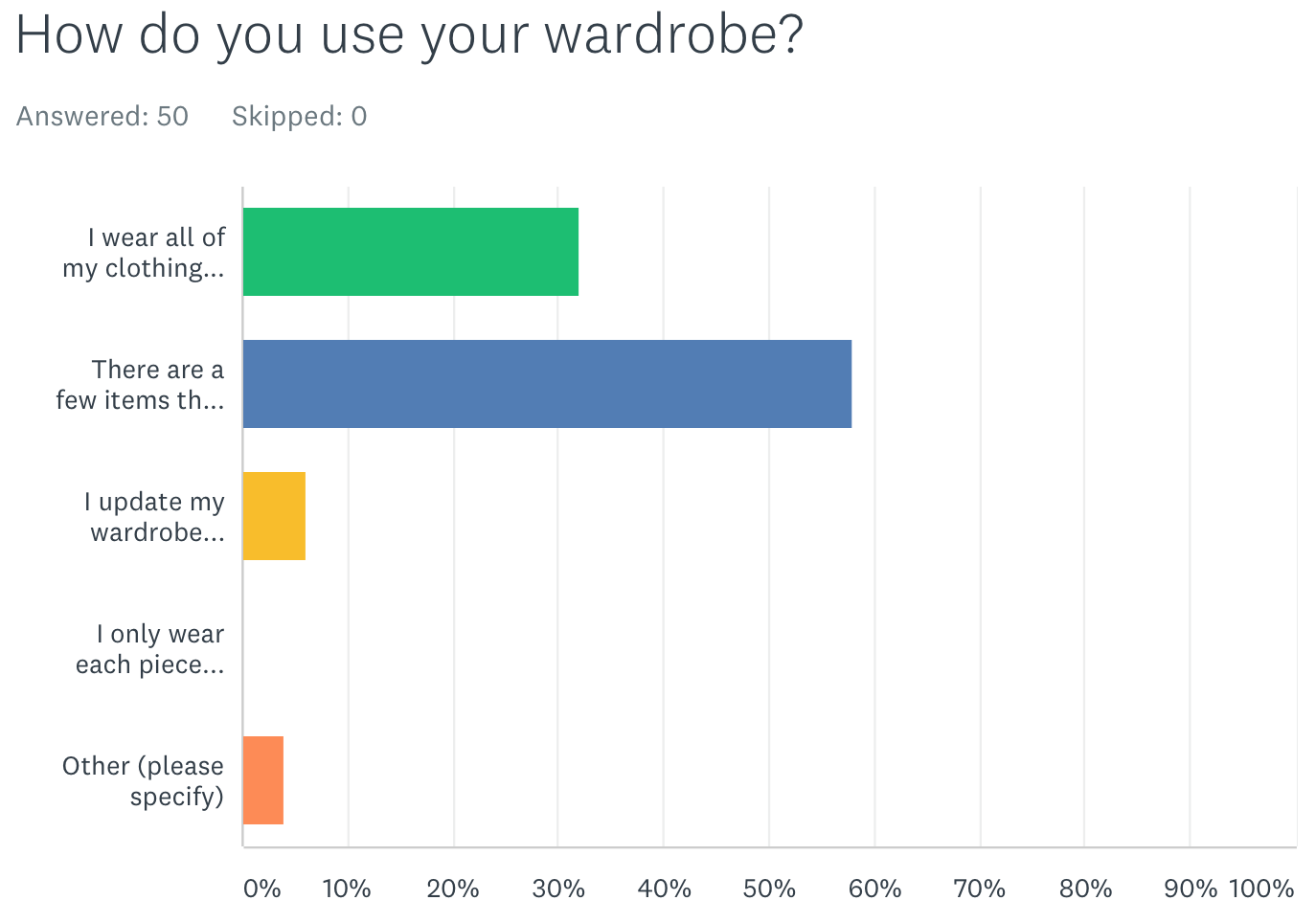

5) How do you use your wardrobe?

We asked our respondents how they use their wardrobe. We wanted to find out how many garments in a women’s wardrobe are actually worn. The most common answer to this question was, ”There are a few items that have never been worn”. As a business we want to promote a capsule wardrobe. A capsule wardrobe consists of a few select garments that are timeless, high quality, and that can be worn multiple ways. The top answer leaves us wondering what happens to these clothes that have never been worn? We also gave respondents the option to choose ”other” as their answer where they could then write a comment. One respondent commented, ”Most of my clothes are worn equally but a few special items are worn less”. We realise that often with evening/occasion wear women tend to get only a couple wears out of the garment. Either the wearer doesn’t attend enough formal events to get the optimal amount of wear out of the garment or, they often don’t want to be seen in the same ”special” garment more than once. Refresh solves this problem by offering a range of designer occasion wear which women can rent specifically for an event. This way the ”special” item costs less, is likely a higher quality, is ethically made, and will receive more wears (from a range of renters).

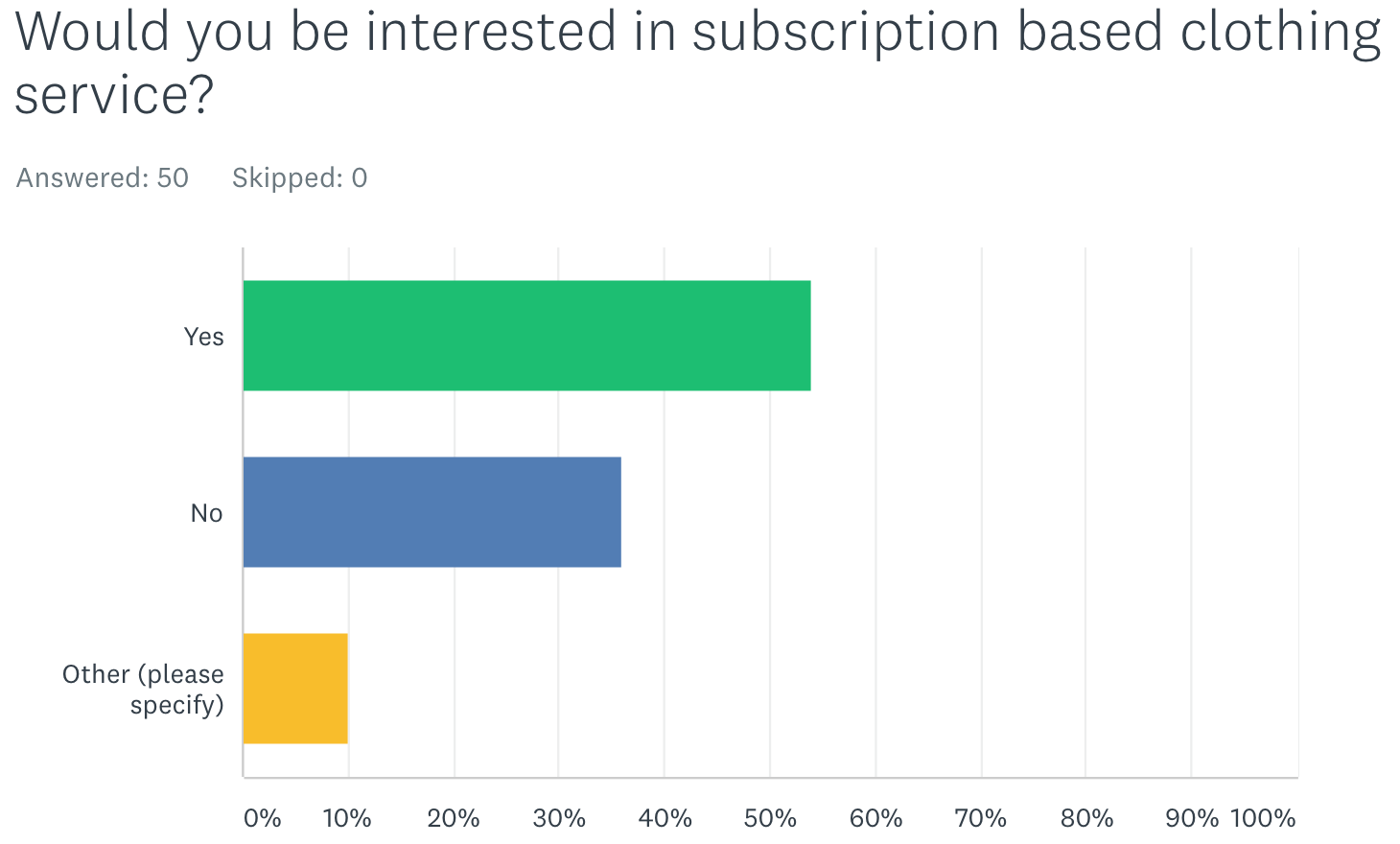

6) Would you be interested in a subscription based clothing service?

We wanted to know what percentage of respondents would actually be interests in a subscription based clothing service. Luckily majority of respondents said they would be interested in this service which is reassuring for Refresh. This question also offered ”other” as an answer. Multiple respondents selected other and commented stating that they were unsure what a subscription based clothing service was. This did not surprise us as there are currently no subscription based clothing services in New Zealand that we are aware of. It does however mean that we need to make sure that we are able to clearly explain how our subscription plan works so that women who are unaware of subscription clothing services become aware.

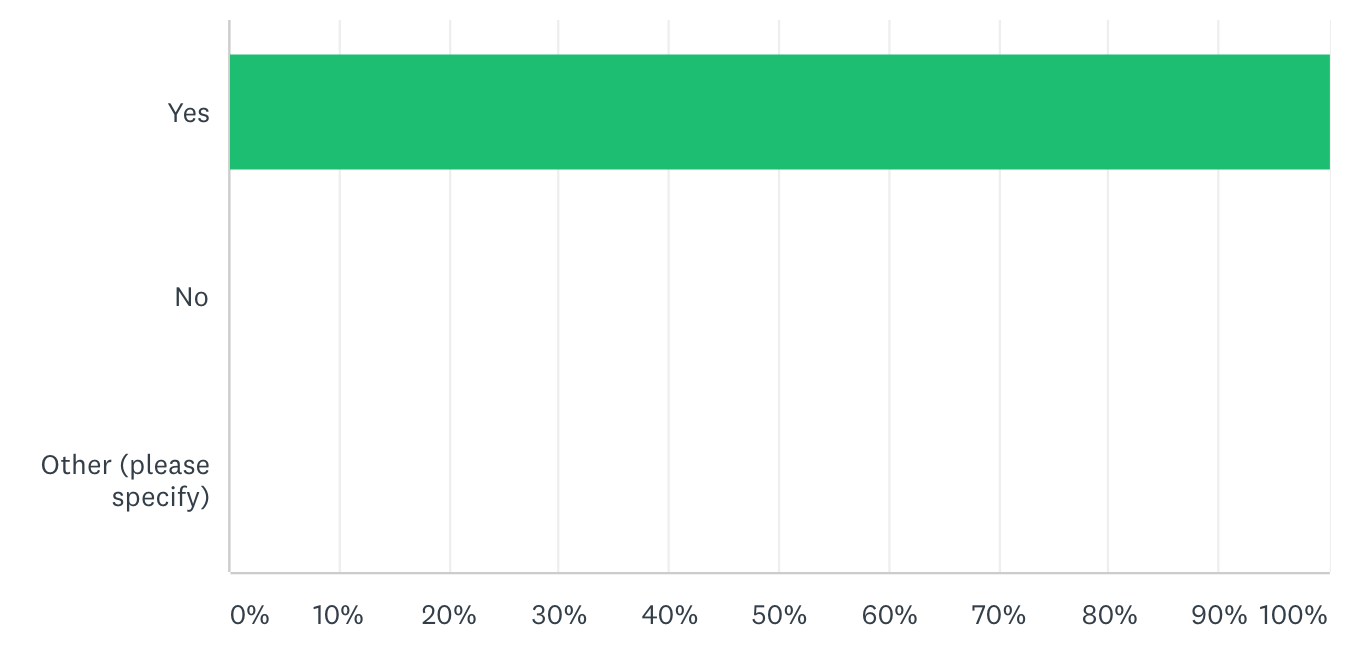

7) Would you wear second-hand clothing?

A rental service means customers are paying to wear clothing that has already been worn by other women. We wanted to make sure that our target market would be happy wearing clothing that has been previously worn by others. All 50 respondents answered yes (they would wear second-hand clothing).

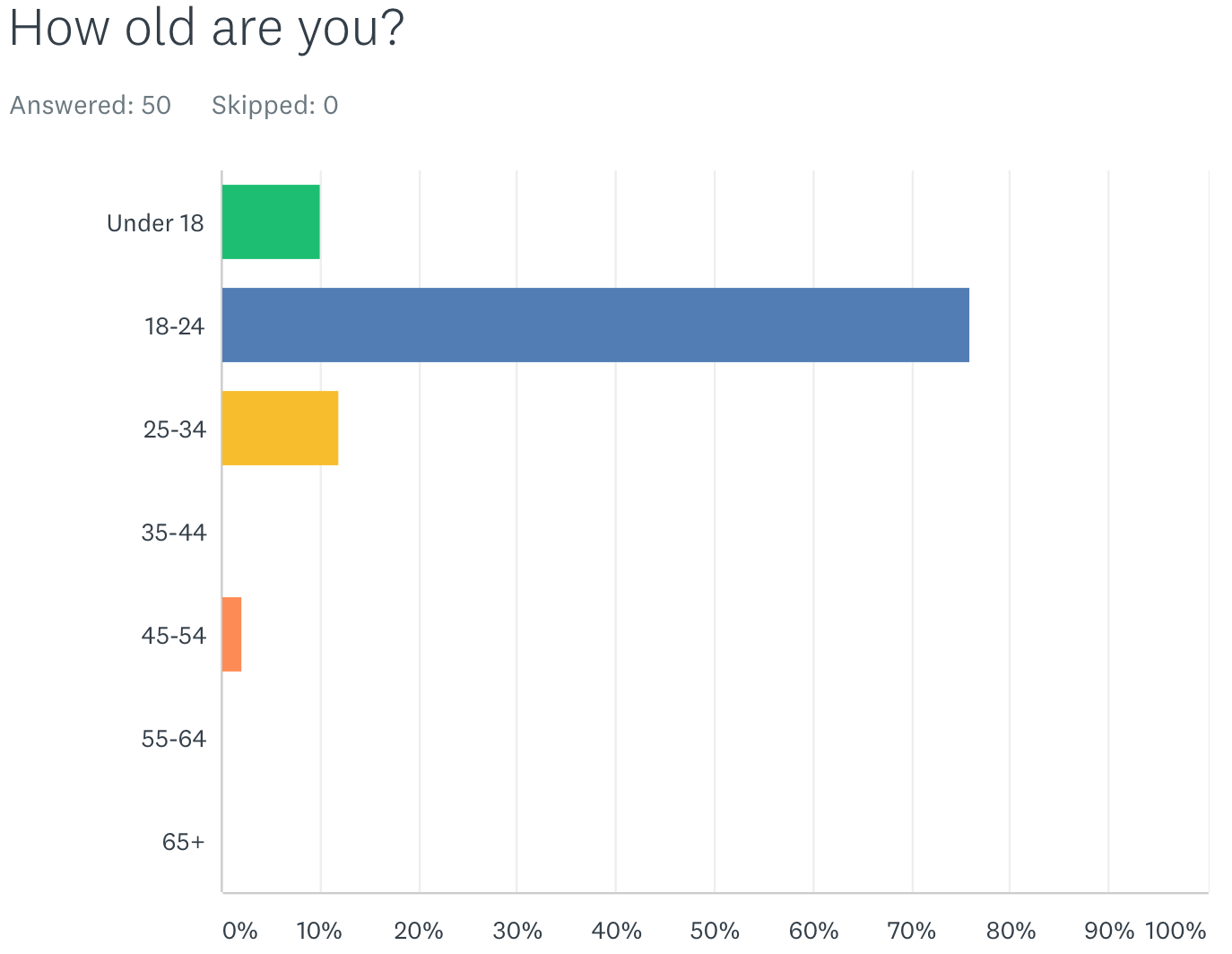

8) How old are you?

We asked this basic question as we wanted to determine the age of our target market. This most common answer by far was 18-24 years. Therefore Refresh will be targeting young adult women aged between 18-30 years.

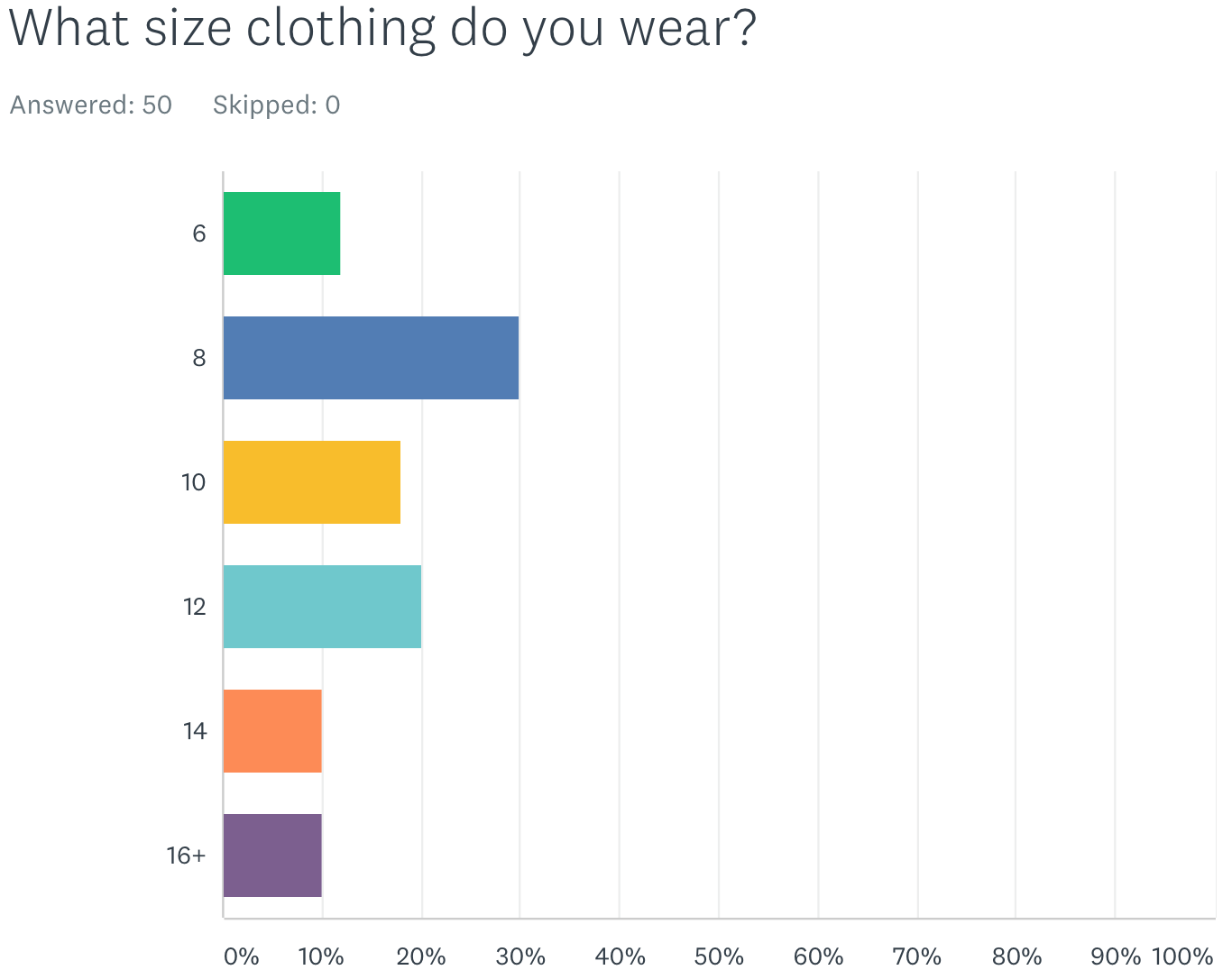

9) What size clothing do you wear?

We asked this question so that we could work out our size ration of garments available on our app. For example, we will require a larger range of size 8 garments compared to size 16 garments as a larger percentage of our audience wear size 8. We have decided we will begin by offering sizes 6-18 through the app. Once the app is more established we hope to look at offering a larger size range to cater to more women.

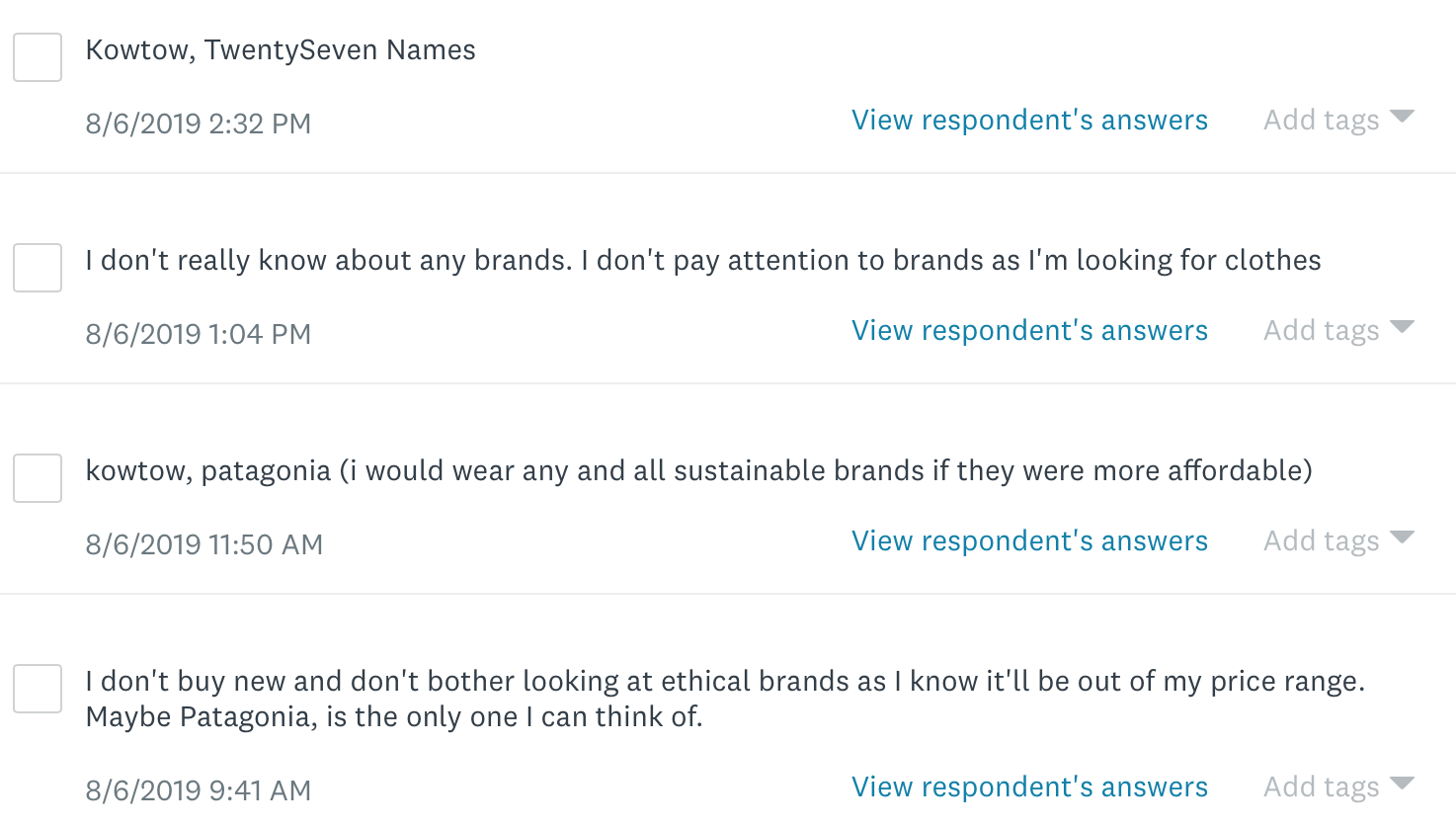

10) What sustainable brands would you wear if they were more affordable?

We asked the respondents to list sustainable brands that they like and would love to wear if they were at a more affordable price point. This question was probably the most interesting in terms of answers. As 3 of our group member’s are fashion students we are very familiar with the idea of sustainable fashion. We didn’t realise that so many women don’t know what sustainable fashion means let along any sustainable brands. This made us realise that not only will Refresh be a rental business but, we will also perform as an educational platform. The app will make customers aware of sustainable clothing brands and hopefully leave them reflecting on the fashion industry and the impact their shopping may be having. We are keen to publish informative articles on the app that will give customers further insight into sustainable fashion. Also, we will partner with ”Good For You”. They are a group of campaigners, fashion professionals and developers who have created a rating system for fashion as a basic method to determine how ethical a garment may be. The rating system has 3 scales; labour, animal, and environment. We will showcase this scale alongside every garment on the app so that our customers make better choices as an informed shopper.

Good For You Rating System: https://goodonyou.eco/how-we-rate/

This final question also let us know what brands our customers would be interested in renting. We want to provide a wide range of brands that our customers support. The answers also informed us of some brands that we are unaware of and will look further into. Common brands answered were,

- Kowtow https://nz.kowtowclothing.com

- Patagonia https://www.patagonia.com.au

- Twenty Seven Names https://www.twentysevennames.co.nz

- Matt and Nat https://mattandnat.com

- Filippa K https://www.filippa-k.com/en

- ENA https://www.iamena.co.nz

- Nope Sisters https://www.nopesisters.com

- Paris Georgia https://www.parisgeorgiastore.com

- Maggie Marilyn https://maggiemarilyn.com